What’s wrong with the earnings season

THE GAME FOR LISTED COMPANIES: EXCEED EXPECTATIONS AT THE EARNINGS SEASON

Investor relations officers of listed companies have long understood the value of positively surprising investors when earnings are released. By creating a positive shock to expectations, the stock price is likely to react positively. So, the game is no longer to publish good results, but simply better results than expected by the consensus of analysts. With the assumption that equity markets reflect the average view of analysts, if a company surprises analysts, it will surprise the markets as well.

The earnings season for the 1st quarter of 2021 is well underway and we can once again see an extremely high surprise rate for this vintage. It is even an all-time high: 87% of S&P500 companies beat analysts’ expectations when posting earnings per share.

This figure appears exceptional and could indicate either: 1) an amazing operating performance of companies during the last quarter or 2) an inability of analysts to understand the activity and correctly estimate the profitability of the companies they cover. Indeed, the surprise rate should be close to 50%. This is what we see for economic forecasts. When it comes to estimate GDP growth, inflation or the unemployment rate, the number is sometimes below expectations, sometimes above. Why do the profit forecasts not follow this same logic? The answer is actually of a different nature: the dice are simply loaded.

AN ASYMETRICAL COMMUNICATION DUE TO REGULATION

87% surprise rate is not a normal number and just tells us that this is not really a surprise but a manipulation. The reasons are as follows:

- Companies have an obligation to publish all inside information “as soon as possible” (MAR regulation, market abuse). The definition of inside information is broad. For example, the French AMF mentions inside information “of a financial nature (such as income loss, the future deterioration in operating income or annual results, the impossibility of achieving forecasts or targeted results previously made known to the public) ”. Bad news (profit warning) therefore does not wait for the earnings publication date to be revealed.

- The regulator does not mention the obligation to disclose good news as soon as possible. Bad news is therefore published before, and good news, during the earnings season.

- Investor relations managers are in constant contact with the analysts who cover their company. They tend to guide them and steer their forecasts.

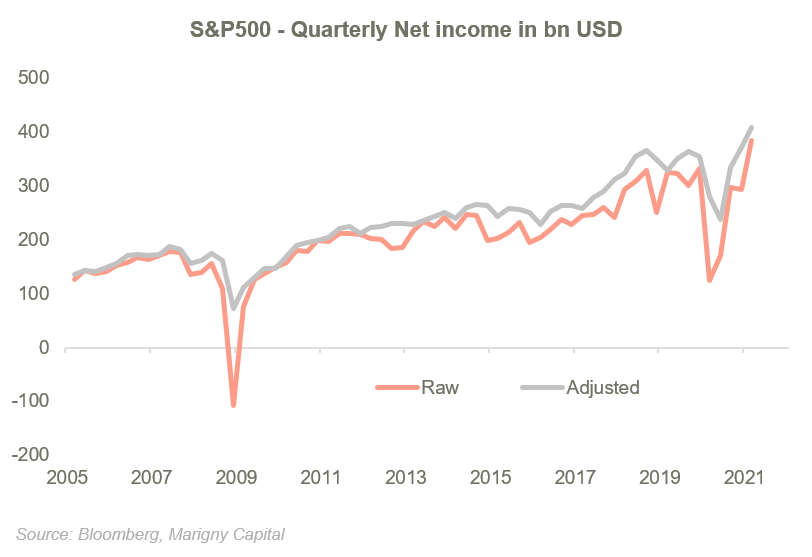

- Companies publish “adjusted” results. Adjusted means that they can clean as they want their accounts by considering as “non-recurring” items that have negatively affected their profits. This accounting trick has grown over years (see graph below) and makes the forecasting task of analysts more difficult.

MARKETS ARE NOT FOOLED

The earnings season is therefore of little interest from the standpoint of the results per se. The scenario is known in advance since the bad news have been pre-announced. There will be good news and analysts will learn only a few things if the post-announcement conference call is interesting and if management has new information to reveal.

Analysts do not seem upset to be surprised every quarter and above all, are no longer impressed by companies who take advantage of this quarterly meeting to congratulate themselves. The same goes for the financial markets.

Indeed, if this game has been played by companies for many years, the markets have also understood the bias for a very long time. The positive anticipation shock no longer has an impact, and the price reaction is also asymmetric, but in the other way.

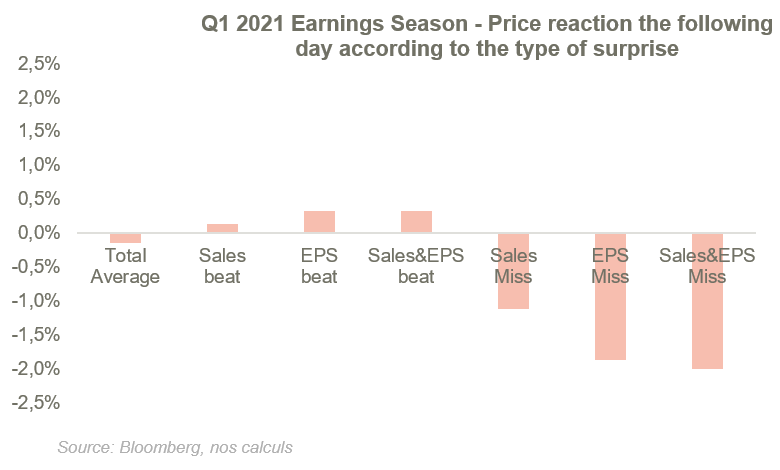

We present on the following chart the average performance of stocks following their earnings publication for the 1st quarter of 2021, depending on the surprise (positive or negative) in terms of turnover and / or earnings per share.

Our calculations show that good surprises don’t really pay off. There is no evidence of a positive anticipation shock when results exceed expectations. In other words, the markets’ efficiency is in full swing. The markets know better how to anticipate the results of the companies than the analysts so that the good surprises are not celebrated.

On the other hand, when the results are below expectations, the market punishes (-2.5% on average when the company surprised negatively for both earnings and sales).

There is therefore a double lesson to be learned:

1) markets structurally anticipate good results better than bad ones

2) for investors, earnings seasons are only interesting for analysing the price’s reaction to publications.

COMPANIES WITH HIGH EXPECTATIONS HAVE BEEN PUNISHED

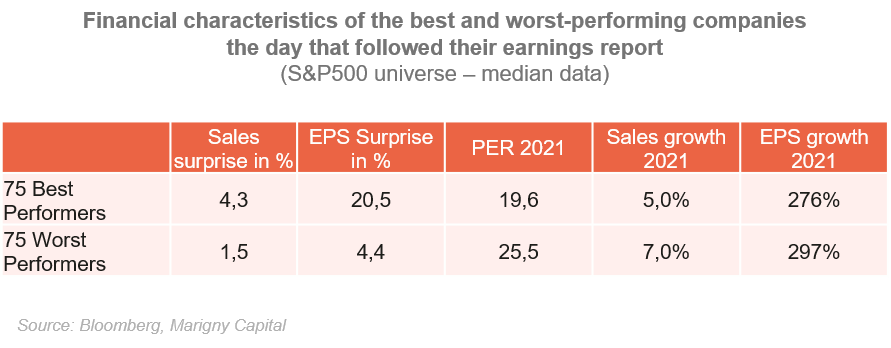

From this perspective, the season which has just ended is interesting. We ranked S&P500 companies according to their performance at the time of their quarterly release. Next, for the 75 extremes, we analysed by how much they beat analyst consensus, and what their financial characteristics were at the start of the year. For the financial characteristics, we have retained three: the P/E 2021 for the valuation criterion and the expected sales and profit growth for the growth criteria. Here are the results.

The best-performing stocks posted sales and profits well above consensus; there is no surprise here. The interesting thing is that they had a little less growth and most importantly, were much less valued (P/E at 19,6 against 25,5).

Statistically, we would say that the valuation factor was the most discriminating factor. So the message is powerful. We know that equity markets are currently expensive. If we look at country indices or sector indices, most trade on valuation multiples never reached before.

The fact that the companies having performed the best during this earnings season in the US are those with a more modest valuation teaches us that “mean reversion” works, that there is a limit to the valuation multiple expansion.

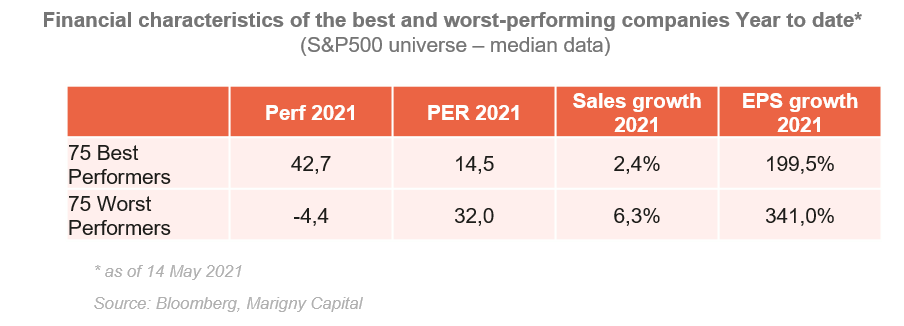

This idea is confirmed if we do the same work as before but this time by ranking the S&P500 companies according to their year to date performance. This is what we show in the table above. The valuation factor appears even more strongly. The best performers this year in the S&P500 universe are companies that had a forward PER at the start of the year of 14.5 while the worst performers had a P/E of 32. Today, the forward PERs stand at 15.4 and 29.3, respectively.

We can thus speak of the start of a mean reverting process. Equity markets seem to have hit a limit in terms of valuation dispersion.

If we look at the sector distribution of these companies, we understand that this earnings season is a continuation of the rotation theme. Positive reacting stocks come from the consumer cyclical, energy and financial sectors while negative reacting companies come from the tech, health care and non-cyclical consumer sectors.

CONCLUSION

We too often hear each quarter comments such as “pay attention to this earnings season, it is going to be important, companies will not have to disappoint”.

Because the dice are loaded, earnings releases are not interesting for what they are but for what they cause. Because the vast majority of companies report better than expected results, attention should be paid to the characteristics of stocks that perform well versus those that perform poorly. It is this information that is valuable and that helps identify opportunities.

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]