The Italian index has not made its revolution

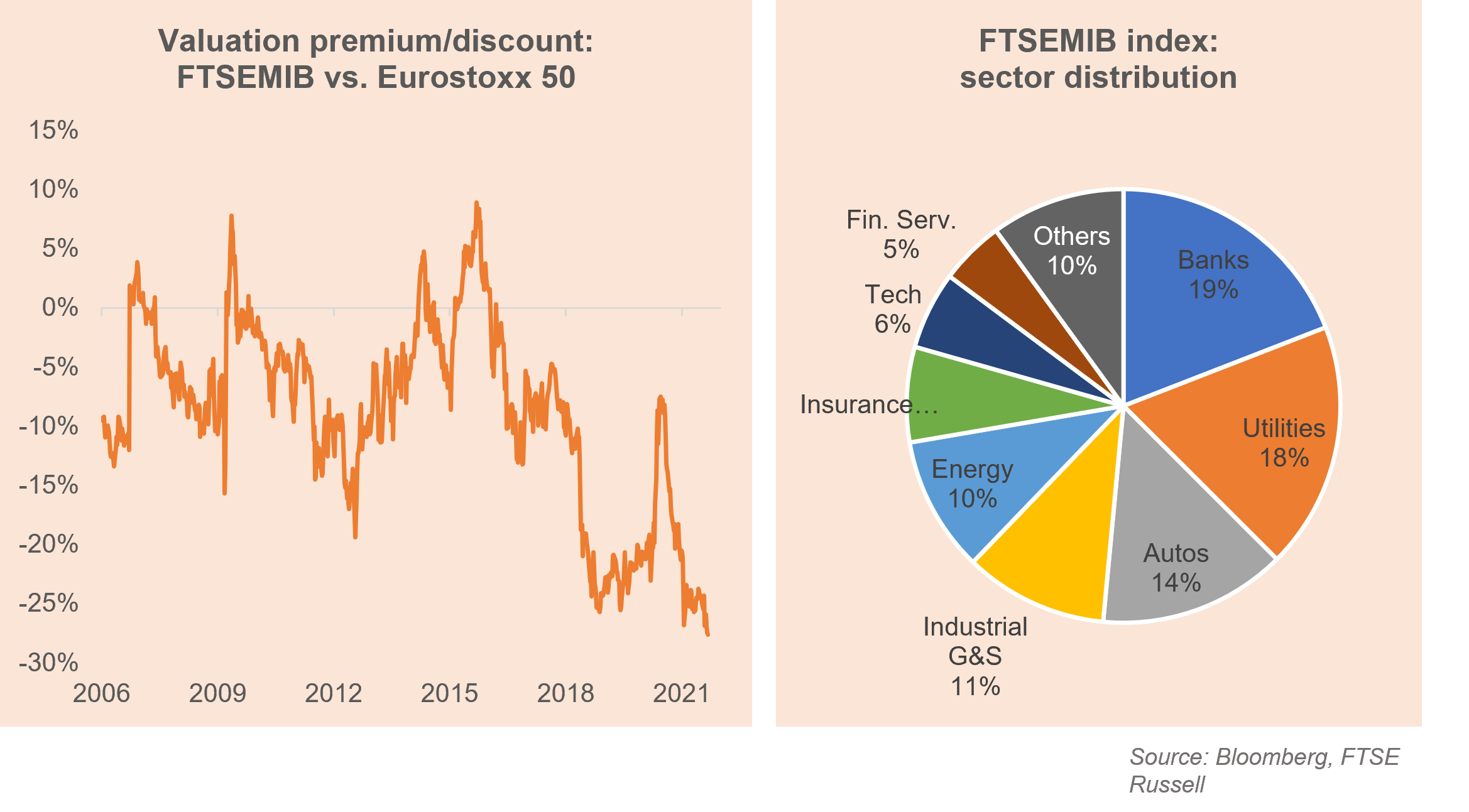

All time low! If we look at the price-to-earnings ratio (PER), the equity Italian index looks extreme since its discount against the Eurostoxx 50 index is at its lowest. This is striking enough given that we are neither in 2009 during the financial crisis, nor in 2012 during the public debt crisis in the euro zone, but indeed in 2021, the year of economic rebound and record growth!

Like any extreme phenomenon, this level of discount calls out. Five years ago the Italian index had the same valuation as that of the Eurostoxx50. Five years later it is trading at less than 12 times its expected profits against 16.5 for the benchmark index in Europe, the Eurostoxx50.

This level is intriguing but is quite explicable (without being justifiable).

The main reason is that the Italian index has not changed. He did not make his Darwinian revolution like the CAC40 and the Eurostoxx50 did. The stocks of the old economy, banks, oil companies, utility companies are still predominant in the index, yet they represent precisely the theme currently neglected by investors.

The latter are enthusiastic about the energy transition or cybersecurity but no longer give value to the previous growth themes. Oil was once a growth theme, like auto or insurance, but it was before.

Can valuation become a supporting factor for these neglected stocks? It’s a good question. If the profits go up, it si a plausible scenario. The challenge is therefore huge for these mature companies to find a dynamic of growth.

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]