The corporate tax rate should increase in the US

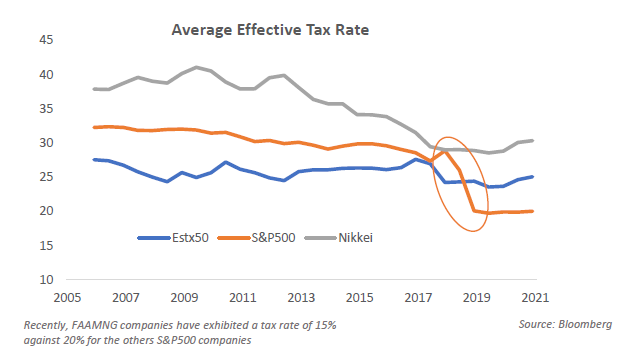

In 2017 Trump made a nice gift to companies by lowering the corporate tax rate from 35% to 21%. Corporates weren’t specifically asking for it, but Trump was convinced that such a tax cut would encourage companies to spend more on investment and wages. It is difficult to conclude today on the effectiveness of this tax cut: the rise in investment and wages is not striking when looking at 2018 and 2019. What is certain is that share buybacks of the S&P500 companies jumped by 55% in 2018 and reach 806 billion dollars which was higher than the total amount of R&D spending in the United States … Among the arguments in favour of lowering the tax rate was that it was slightly higher than that in Europe.

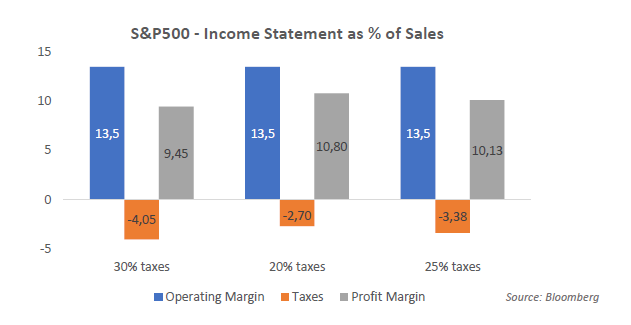

Biden wants to reverse this tax gift by 50%, i.e., raising the rate from 21% to 28%. At the S&P500 level, we note that the 2017 tax cut increased profits by 14.3% (net margin that went from 9.45% of turnover to 10.8%). A rise in the tax rate would result in a 6.3% drop in profits (net margin from 10.8% to 10.13%).

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]