Residential construction: different dynamics depending on the country

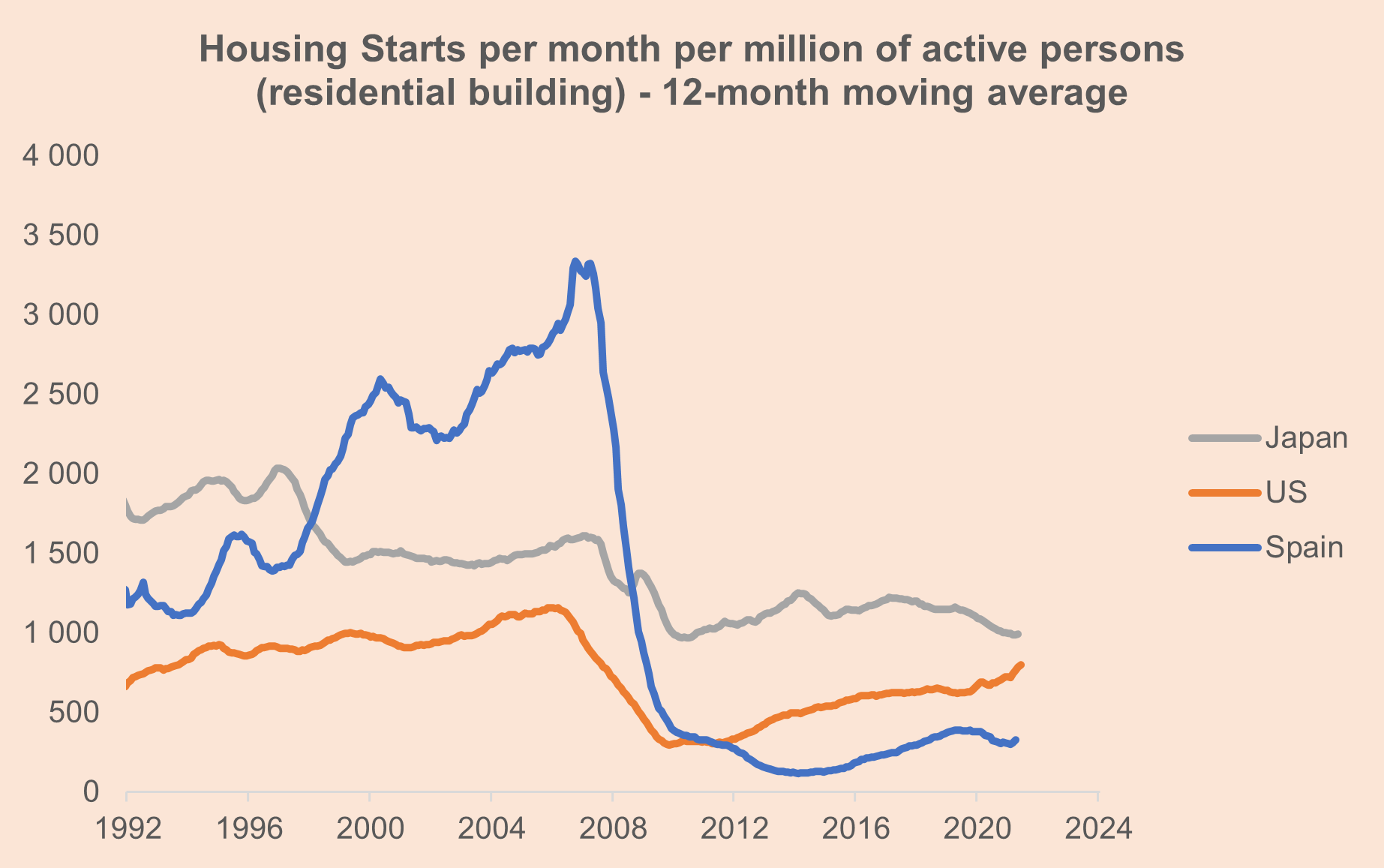

This graphic is one of our favorites. He tells a lot of stories. It shows the evolution of housing starts in 3 very different countries. We normalized these data by the labor force size in order to make relevant the comparison between the series.

The real estate bubble of the 2000s in Spain impresses with its duration and its magnitude. The real estate boom in the United States at the same time seems quite modest in comparison.

More recently, we observe that the rebound in residential construction activity in the United States is accelerating while in Spain, the sector appears to be suffering from a form of structural lethargy.

But the most interesting is Japan. Despite an aging population, do you know why the construction sector is so dynamic? Why are more houses built there than elsewhere (if we adjust for the demographic factor)?

The answer relates to institutional factors. The culture is very different in Japan and real estate is no exception. Investing in housing is not widespread. The house is seen more as a consumer good rather than an investment. In Japan, houses are often demolished in order to rebuild them. This is done naturally (earthquakes) or by regulation: the houses are depreciated over twenty years and then the residual value is close to zero, only the land is worth something. The culture is therefore very different from Europe where the house is sacred and represents a personal life achievement. In Japan, when you buy a house, you demolish it to rebuild another with materials that are not necessarily good quality but new. Also, this is a way to ensure that it will meet new anti-seismic standards which change regularly.

Finally, beliefs are also very strong and demolishing and rebuilding a house is a way to drive away evil spirits!

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]