Is the sky the limit?

We can question the fundamental value of certain goods like copper, the bitcoin or an Empire-era semainier. The problem with these three assets is that they do not detached dividends, so it is difficult to value them from a financial point of view. Their value lies in the utility they provide and their price is therefore a function of preferences.

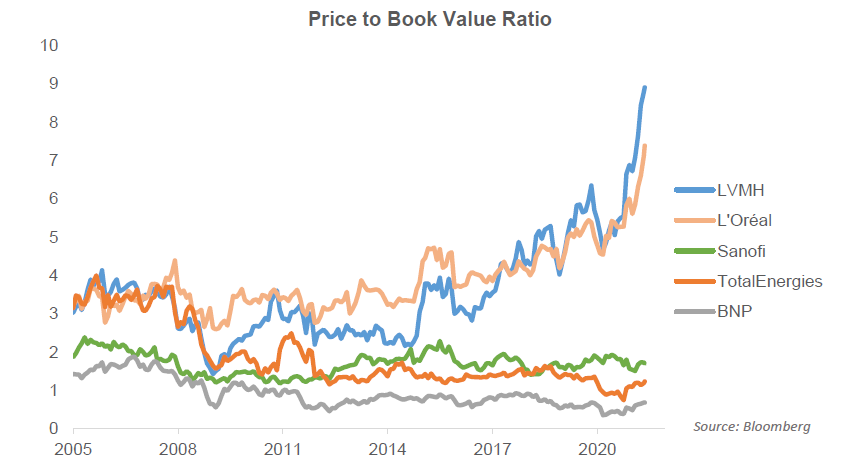

For financial assets that detach a coupon, valuation is somewhat less subjective. For stocks, there is even the socalled book value that evaluates the net assets of the company. This valuation is generally a liquidation value (difference between the forced sale of assets and the debt). If we compare the market value to the book value, we get the price-to-book. The higher this ratio, the more investors will value the book value of tomorrow; in other words, the ability of the company to do better in the future.

LVMH and l’Oreal – the two largest French stocks – have benefited from an extraordinary enthusiasm in this cycle. Last year we thought that this phenomenon was linked to the sanitary crisis: a quest for secure growth companies ina world in growth deficit. But in 2021 the phenomenon continues, or even accelerates !

Below we compare these two leaders with the three previous leaders: BNP, Sanofi et Total.

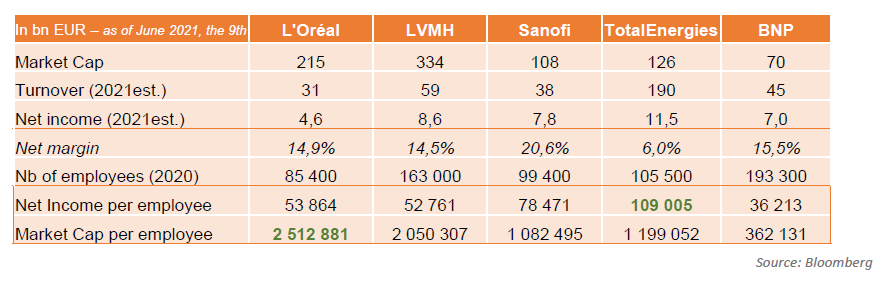

The table can be read as follows: each TotalEnergies employee generates 109k euros in profits, which is twice what an employee at LVMH does. However, his work is valued half by the financial markets. The work of a BNP employee is valued 7 times less than the work of a L’Oréal employee.

The table can be read as follows: each TotalEnergies employee generates 109k euros in profits, which is twice what an employee at LVMH does. However, his work is valued half by the financial markets. The work of a BNP employee is valued 7 times less than the work of a L’Oréal employee.

Categories

Last articles

Consumers’ payment habits in Europe

The ECB conducted a study on payment habits in Europe in 2019: Study on the Payment Attitudes of Consumers (SPACE); https://www.banque-france.fr/sites/default/files/media/2021/11/25/space_2020-12.pdf. Although the covid crisis has certainly changed these habits, the analysis remains relevant to compare the differences in practices within Europe..

Robinhood – a textbook case of financial analysis

Robinhood was created in 2013 in the San Francisco area, a few miles from Stanford University. It was at this prestigious university that Vlad Tenev and Baiju Bhatt met. Their ambition was strong: to democratize the financial markets by offering easy access to all apprentice traders. Their slogan was quickly found: “Investing for Everyone”. They […]